中国汽车制造业企业区位及其影响因素

智能化、自动化、共享化和电动化驱动全球汽车产业百年一遇的大变革[1],给中国汽车产业带来巨大的机遇和挑战,激发新一轮创业热潮[2]。上海汽车集团等传统造车势力加强与阿里巴巴集团等互联网巨头合作,设立人工智能实验室,加快推进互联网技术与汽车产业深度融合。蔚来、小鹏、威马、理想等造车新势力大举进军新能源汽车领域[2]。移动出行平台滴滴以及电子信息产品制造商小米等其他行业巨头纷纷进入汽车制造领域。除了企业积极响应汽车产业大变革之外,中国多个地方政府鉴于汽车产业供应链长、对区域经济波及效应强,加大对汽车制造业的支持力度[3]。企业与地方政府共同推动中国兴起“造车热”[4]。

学者已注意到中国汽车生产从高度集中转变为相对集中[5],在全国尺度上中国汽车制造业产业集聚程度不断减弱,空间分散程度增强[6]。受劳动力、土地、资源生产要素成本上升等原因影响,中国汽车产业逐渐向中西部转移[7⇓-9]。在区域尺度上,中国汽车产业呈现出集聚与扩散并存的特征,如北京市和天津市周围出现沧州、廊坊等多个新兴汽车产业集聚地区[10]。已有研究多采用2013年及之前的数据进行分析;2013年及之后中国新能源汽车加速发展,但这一时期中国工业企业数据库并未公开。以下3个问题的探讨仍有待进一步深化:第一,2013—2021年,中国汽车制造业企业布局是否仍具有一定的延续性,趋向汽车产业基础较好的地区集聚?第二,新能源汽车选址是否与传统汽车制造业的布局相偏离?第三,在汽车智能化、电动化背景下,哪些城市实现了汽车、电气机械和器材(电气)以及计算机、通信设备和其他电子设备(电子)制造业共同集聚?

学者在地方化经济[11⇓-13]、城市化经济[14-15]、制度和全球化[16]等维度采用指标分析中国汽车制造业区位因子。已有研究关注到前一年城市和地区汽车制造业从业人员区位商对新创汽车企业区位选择具有正向的影响[9],发现制度和外商投资等因素对中国汽车工业布局具有显著影响[16]。综合来看,对汽车制造业区位因子的评估仍有深化的余地。第一,需要采用更长时段的地方化经济指标评估产业发展历史基础对产业发展现状的影响[17⇓-19]。第二,产业多样化与知识复杂性对区域产业发展的影响已成为国内外研究热点[20⇓-22],需要进一步检验制造业多样化指数和制造业知识复杂性对汽车制造业企业区位选择的影响。第三,鉴于汽车、电子、电气三大产业融合发展的趋势[1],还需要分析电子和电气制造业集聚对汽车制造业企业选址的影响。

综上所述,本文基于2013年和2021年微观企业数据库,分析中国汽车制造业区位及其影响因素。研究有助于丰富中国产业区位论,并为汽车制造业企业选址和政府产业布局规划提供依据。

1 数据与方法

1.1 数据来源

1.1.1 2021年中国制造业企业数据库

“国家企业信用信息公示系统”是中国国家市场监督管理总局公开发布的微观企业数据库。本文基于天眼查平台,获取源自“国家企业信用信息公示系统”的中国制造业企业数据。该数据库属性字段包括企业名称、行业分类代码、注册时间、注册资本、经营状态、营业范围、经营地址等信息。截至2021年12月31日,该数据库中注册资本在1000万元及以上且经营状态为存续的制造业企业样本数量为732620家,分布在368个地级及以上城市和地区。这些企业归属于31个两位数制造业门类。本文根据汽车制造业企业两位数行业代码筛选出汽车制造业企业(包括整车、零部件和配件制造细分类别)总数为24581家,占中国制造业企业数量的3.36%,分布在317个地级及以上城市和地区。本文根据企业经营范围是否具有“新能源汽车”或“电动汽车”制造等业务,划分新能源汽车制造业企业和传统汽车制造业企业两个类别。前者和后者数量分别为2496家、22085家,占全国汽车制造业企业数量比例分别为10.15%、89.85%,反映出2021年中国汽车制造业企业类别结构中仍以传统汽车制造业企业为主。

1.1.2 2013年中国工业企业数据库

该数据库包括截至2013年12月31日经营状态为存续且营业收入在2000万元及以上的规模以上工业企业数据。企业样本总数为344875家,分布于359个地级及以上城市和地区。企业属性字段包括企业经营地址、行业分类代码、工业总产值、从业人员数量等信息。本文根据汽车制造业企业两位数行业代码筛选出汽车制造业企业(包括整车、零部件和配件制造细分类别),总数为11929家,占中国工业企业数量比例为3.46%,分布于253个地级及以上城市和地区。

1.2 指标选取

1.2.1 地方化经济

同一行业企业空间集聚形成的地方化经济,有利于企业利用专业化的劳动力市场、中间品市场和专业服务业市场,吸收企业间的知识溢出,降低各种成本[22]。相关研究表明,产业集聚具有自我增强的效应,一旦形成,会吸引更多同类企业集聚。产业集聚本身成为了影响企业区位决策的重要影响因素[23-24]。已有研究表明,专业化供应链和专业化劳动力带来的地方化经济有利于汽车产业跨国公司生产功能区位选择[25]。

本文基于式(1)计算2013年中国汽车制造业区位商( ),刻画地方化经济:

式中: 表示c城市中i产业的企业数量[26]。如果产业部门i的企业数量占所在城市c所有企业数量比例大于该产业的企业数量占中国的比例,那么城市c在行业i具有专业化优势[26]。预期该指标越高,越有利于吸引汽车制造业企业。

1.2.2 城市化经济

汽车制造业成长过程与其他产业具有密切关联[27⇓-29]。中国企业在电动、网联、共享和自动驾驶等知识复杂性较高的技术领域具备了坚实的动态能力,有利于中国参与世界新一轮汽车产业革命[30]。

本文采用制造业多样化指数、制造业知识复杂性、电子制造业区位商、电气制造业区位商和常住人口规模来刻画城市化经济。预期上述5个指标越高,越有利于吸引汽车制造业企业。

本文采用式(1)测算电子制造业和电气制造业区位商;采用式(2)计算制造业多样化指数(VAR):

式中 是城市和地区两位数代码制造业行业企业数量占全部行业企业数量的比例[31]。

本文基于张翼鸥等[26]的方法,建立中国368个城市和地区在31个制造业细分行业的区位商二模矩阵N。首先对二模矩阵N进行二值化处理,生成二模矩阵M,如果在二模矩阵中 大于1则取1,否则为0[26]。

通过二模矩阵M计算城市和地区行业多样化指数(DIVERSITY)。该指数与城市—行业二模网络中所有节点的度数中心性有关。城市的度数中心性( )表示某个城市和地区拥有相对行业优势的行业数量。该数值越大则反映城市在更多的行业领域具有优势[26],如式(3)所示:

式中: 表示城市c在产业i中是否拥有专业化优势。

最后经过n次迭代的多样性整合指标可以测度城市和地区制造业知识复杂性[26],如式(4)所示:

式中: 表示城市的知识复杂性; 表示n次迭代的城市和地区的多样化指数。

1.2.3 经济全球化水平

中国凭借强大的国家能力以及超大规模市场的吸引力,通过合资形式引进外国汽车整车厂,形成本地供应链,推动了汽车产业发展[32]。本文把城市和地区2020年规模以上外资工业企业数量作为衡量城市经济全球化水平的指标。预期城市经济全球化水平越高,越有利于汽车制造业企业集聚。

因变量和地方化经济、城市化经济、经济全球化水平3个维度的自变量测度方法如表1所示。

表1 研究变量定义与测度Tab.1 Definition and measurement of the variables

变量维度 变量名称 测度方法 数据来源 回归系数符号预期 因变量 2021年汽车制造业企业数量 汇总统计各个地级及以上城市汽车制造业企业数量 2021年中国制造业企业数据库 地方化经济 2013年汽车制造业企业区位商 参考张翼鸥等[26]计算 2013年中国工业企业数据库

+ 城市化经济

制造业多样化指数 参考Frenken等[31]计算

2021年中国制造企业数据库

+ 制造业知识复杂性 参考张翼鸥等[26]计算 2021年中国制造企业数据库

+ 常住人口数量 汇总各城市和区域2020年第七次人口普查数据 中国各城市和区域2020年第七次人口普查公报 + 计算机、通信设备和其他电子设备制造业企业数量区位商 参考张翼鸥等[26]计算 2021年中国制造业企业数据库 + 电气机械和器材制造业

企业数量区位商 参考张翼鸥等[26]计算 2021年中国制造业企业数据库 + 经济全球化水平 规模以上外资工业企业数量 源于《中国城市统计年鉴2021》汇总数据 《中国城市统计年鉴2021》 +

本文获取了280个地级及以上城市和地区自变量数据,自变量描述性统计如表2所示。

表2 研究自变量描述性统计Tab.2 Descriptive statistics of the variables

变量 平均值 标准差 最小值 最大值 汽车制造业区位商 0.80 1.30 0 14.21 制造业多样性指数 2.80 0.18 2.07 3.11 制造业知识复杂性 28.65 19.96 0.44 100.00 2020年常住人口(万人) 337.21 432.11 28.16 3205.42 电子制造业企业数量区位商 0.72 0.89 0 10.41 电气制造业企业数量区位商 0.72 0.54 0 4.69 规模以上外资工业企业数量(个) 83.58 262.09 0 28381.3 模型设定

各城市和地区全部、新能源和传统汽车制造业企业数量方差与平均值比值分别为87.26、16.82、251.14。上述3个计数样本的方差远大于平均值,呈现超离散特征,不符合泊松回归模型的假设,需用负二项回归模型来描述这种现象[33]。

负二项模型具体如式(5)所示[33]:

式中: 为超离散程度,服从均值为0、方差为α的伽马分布,当α=0时,该模型便成为泊松回归模型[33]; 为模型中的偏移量,通常为常数; 为自变量; 为常数; 、 、 为系数; 是因变量 的估计参数, 服从泊松分布:

2 中国汽车制造业企业区位特征分析

2.1 整体上趋向汽车制造业发展基础较好的城市集聚,兼具延续和变化双重特征

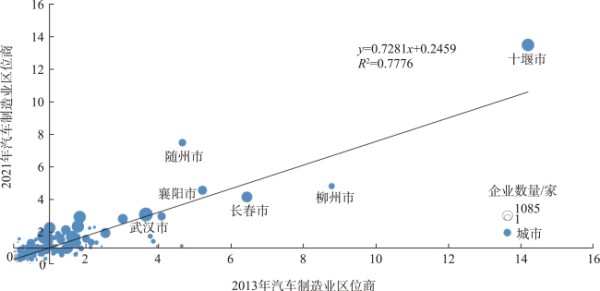

2021年和2013年两个年度的中国城市汽车制造业区位商呈现出正相关关系(图1)。从整体上来看,中国汽车制造业企业趋向产业发展历史基础较好的城市集聚。

Fig.1 Regression result of the location quotient of China's city and regional automobile manufacturing industry in 2013 and 2021

Full size|PPT slide

本文参考邓向荣等[34]的方法,比较2013年和2021年两个年度汽车制造业区位商。若两个年度某城市汽车制造业区位商均大于1,则认为该城市维持了汽车制造业专业化优势;若2013年某城市汽车制造业区位商小于1,2021年大于1,则认为该城市取得汽车制造业专业化优势;若2013年和2021年某城市汽车制造业区位商均小于1,则认为该城市并未取得汽车制造业专业化优势;若2013年某城市汽车制造业区位商大于1,2021年小于1,则认为该城市失去汽车制造业专业化优势。

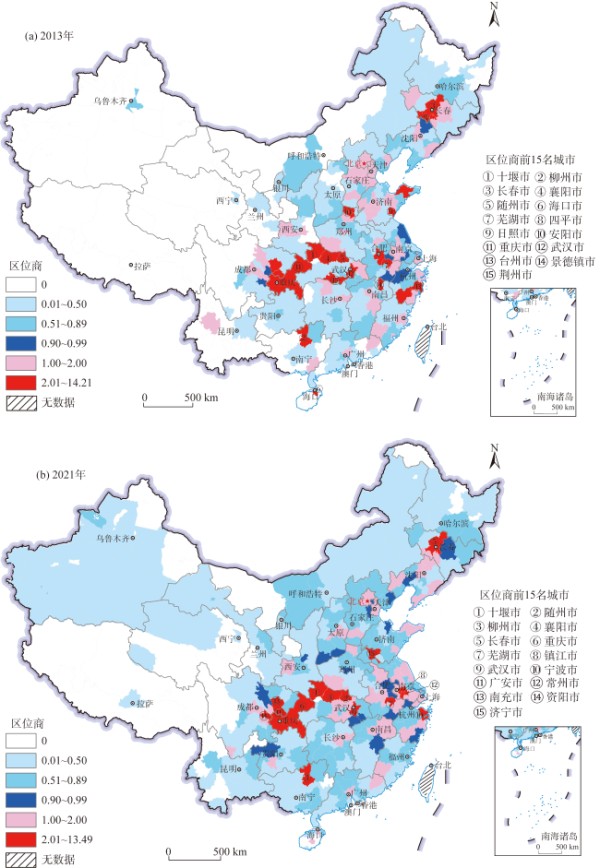

从产业布局延续的视角来看:一些汽车产业发展历史基础较好的城市维持优势。2013年和2021年重庆市、十堰市、宁波市、镇江市、上海市、常州市、长春市、台州市等45个城市汽车制造业区位商均大于1,维持了汽车制造业专业化优势(图2、图3)。另一些汽车产业基础发展较差的城市延续劣势。泰州市、青岛市、南通市、杭州市、绍兴市等229个城市在2013年和2021年汽车制造业区位商均小于1,并未取得汽车专业化优势(图2、图3)。

Fig.2 Location quotient of automobile manufacturing industry in Chinese prefecture-level and above cities in 2013 and 2021

Full size|PPT slide

Fig.3 Classification of Chinese cities based on changes in location quotient of automobile manufacturing industry

Full size|PPT slide

从产业布局变化的视角来看:一些城市汽车制造业由弱变强,苏州市等21个城市2013年汽车制造业区位商小于1,2021年大于1,取得了汽车制造业专业化优势。另一些城市汽车制造业则由强变弱,温州市等22个城市2013年汽车制造业区位商大于1,2021年小于1,失去了汽车制造业专业化的优势(图2、图3)。

值得注意的是,2013—2021年,苏州市、无锡市、盐城市、嘉兴市、淮安市、六安市、宿州市、淮北市等地实现汽车制造业专业化优势,使得长三角具有汽车制造业专业化优势的城市在空间上连绵成片(图2b、图3)。2021年,长三角地区(江苏、浙江、安徽、上海)集聚优势最为突出,吸引了10030家汽车制造业企业,占全国汽车制造业企业数量比例为40.80%,已成为中国汽车制造业最为重要的集聚地带。长三角地区拥有汽车制造业区位商大于1的城市有21个,占全国汽车制造业区位商大于1的城市总数比例为31.82%,其中苏州市拥有1085家汽车制造业企业,占全国汽车制造业企业数量的14.41%,成为中国汽车制造业企业数量最多的城市。

2.2 新能源汽车制造业选址和传统汽车制造业布局正相关,路径依赖与路径突破并存

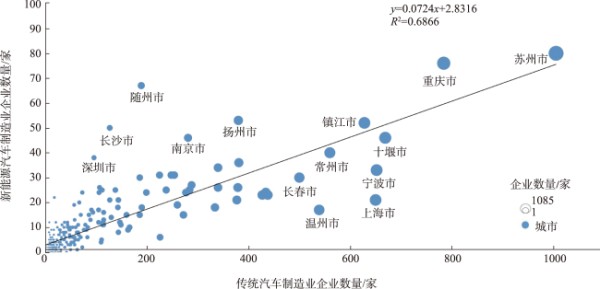

从产业发展路径依赖的视角来看,2021年中国城市新能源汽车制造业企业数量与传统汽车制造业企业数量呈现出正相关关系(图4)。新能源汽车制造业企业数量前10强城市中,苏州市、重庆市、镇江市、十堰市均为传统汽车制造业数量前10强城市;随州市、扬州市、南京市传统汽车制造业企业数量分别位于全国第33名、第14名、第22名,也是传统汽车制造业较为发达的城市。这表明传统汽车制造企业集聚的城市仍具有发展新能源汽车产业潜力[35-36]。

Fig.4 Regression result of the number of traditional automobile manufacturing enterprises and the number of new energy automobile manufacturing enterprises across different cities in China

Full size|PPT slide

从产业发展路径突破的视角来看,长沙市和深圳市传统汽车制造业企业数量分别位于全国第46名和第60名,两个城市新能源汽车制造业企业数量分别位于全国第6名和第10名。表明在汽车产业大变革时期,这两个传统汽车制造业发展并不突出的城市在新能源汽车制造业领域取得了突破。

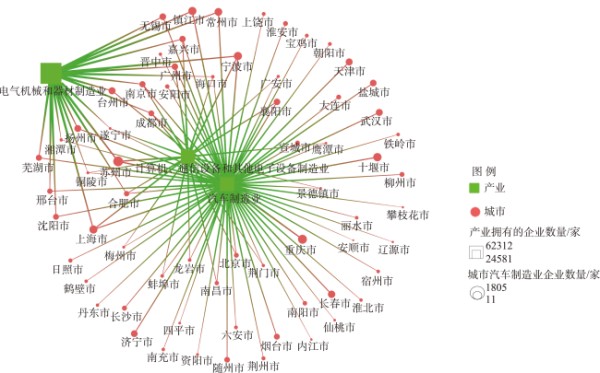

2.3 上海等11个城市实现汽车、电子、电气三大产业共同集聚

本文采用Tulip软件将区位商大于1的产业与其对应的城市相连接,形成汽车、电子、电气三大产业共同集聚网络(图5)。在2021年,中国多数城市并未实现汽车、电子、电气三大产业共同集聚,只有上海市、成都市、广州市、海口市、合肥市、嘉兴市、南京市、宁波市、苏州市、遂宁市、铜陵市等11个城市汽车、电子、电气三大制造业企业区位商均大于1(图5)。

Fig.5 Co-agglomeration network of automobile, electronics, and electrical industries (location quotient>1) in Chinese cities

Full size|PPT slide

3 中国汽车制造业企业区位影响因素分析

3.1 回归分析结果

本文对表2中自变量进行多重共线性检验,各变量VIF中最大数值为2.24,最小数值为1.06,不存在严重的多重共线性问题。本文采用Stata 14.0软件,将这些变量代入到负二项模型中进行回归分析。结果如表3所示。

表3 回归分析结果Tab.3 Regression analysis results

自变量 全部汽车制造业企业 新能源汽车制造业企业 传统汽车制造业企业 制造业多样性指数 1.8008** 0.8323** 1.7872** 制造业知识复杂性 0.0357** 0.0224** 0.0368** 电子制造业区位商 -0.2227** -0.0680 -0.2512** 电气制造业区位商 0.1206 -0.0437 0.1280 2013年汽车制造业区位商 0.3827** 0.2398** 0.3930** 规模以上外资工业企业数量 0.0004* 0.0002 0.0004* 常住人口数量 0.0008** 0.0006** 0.0009* 伪R2 0.1463 0.1338 0.1507 N 280 243 277注:*、**分别表示P < 0.05、P < 0.01。3.2 结果解释

(1) 地方化经济有利于汽车制造业企业集聚

2013年汽车制造业区位商对2021年新能源汽车和传统汽车制造业企业数量的影响均为正向,且都通过了1%的显著性水平检验(表3),表明2013年汽车制造业企业集聚形成的地方化经济是新能源和传统两个类别的汽车制造业企业的选址均考虑的因素,进一步证实了历史积累对汽车制造业发展的重要意义[27-28]。

(2) 常住人口规模大、制造业多样化指数和复杂性高有助于吸引汽车制造业企业

从城市化经济维度来看,城市常住人口对新能源和传统汽车制造业企业数量的回归系数为正,且分别通过了1%和5%的显著性水平检验(表3),说明了常住人口规模越大的城市,越有利于吸引汽车制造业企业。制造业多样性指数以及知识复杂性对新能源汽车和传统汽车制造业企业数量的回归系数均为正,且通过了1%的显著性水平检验。这也反映出了汽车制造业是综合性制造业[27-28],对区域制造业多样性及其知识积累质量有一定的要求。

(3) 传统汽车制造业选址趋向外资集聚的城市,与电子制造业企业集聚地区相背离

规模以上外资工业企业数量对传统汽车制造业区位具有正向的影响,对新能源汽车制造业区位选择的影响未通过显著性检验(表3)。中国在传统汽车制造业发动机等核心技术领域与日本、德国、美国等传统汽车制造强国相比仍有较大技术差距[37]。中国传统汽车制造业企业在外资工业企业集聚的地区选址,有助于其加强与外资工业企业的产业联系。

电子制造业区位商对传统汽车制造业企业的区位选择具有负向影响,反映出传统汽车制造业和电子制造业区位选择相对分离的现实。

(4) 电子和电气制造业集聚对新能源汽车制造业企业区位选择的影响未通过显著性检验

电子和电气两大制造业区位商对新能源汽车制造业企业区位选择的影响未通过显著性检验。换言之,一部分中国新能源汽车制造业企业在选址时,注重电子、电气产业集聚[38],另一部分则并未注重电子和电气产业集聚。

4 结论与讨论

4.1 结论

本文基于2013年和2021年微观企业数据库,采用区位商等指标分析中国汽车制造业区位特征,从城市化经济、地方化经济、经济全球化3个维度构建指标体系,采用负二项回归分析方法分析中国汽车制造业区位影响因素。主要结论如下:

(1) 中国汽车制造业布局具有延续和变化双重特征。从延续的视角来看,重庆等45个汽车制造业发展历史基础较好的城市维持了汽车制造业专业化优势,泰州等229个汽车产业历史基础发展较差的城市并未实现汽车制造业专业化优势。从变化的视角来看,苏州市等21个城市实现汽车制造业专业化优势,温州市等22个城市失去汽车制造业专业化优势。

(2) 中国新能源汽车制造业企业选址具有路径依赖和路径突破双重特点。从路径依赖的视角来看,中国新能源汽车制造业企业选址与传统汽车制造业布局正相关,传统汽车制造业集聚的城市在发展新能源汽车产业上仍然具有潜力。从路径突破的视角来看,传统汽车产业基础较弱的长沙市和深圳市等城市在发展新能源汽车产业上取得了一定突破。

(3) 中国只有上海、合肥、苏州等11个城市实现汽车、电子和电气三大制造业共同集聚。

(4) 制造业多样化指数、制造业知识复杂性、常住人口数量、2013年汽车制造企业区位商有助于城市和区域吸引汽车制造业企业。传统汽车制造业选址趋向于外资集聚的城市,偏离电子制造业企业集聚的城市。电子、电气制造业区位商以及外资工业企业数量对中国新能源汽车制造企业区位选址的影响未通过显著性检验。

4.2 讨论

(1) 区域产业发展存在着“路径依赖”的特征[39]。当前中国汽车制造业呈现出多个区域齐头并进的发展格局,需要按照“区域集聚”的原则[40],推动汽车制造业企业进一步向汽车产业历史基础比较好、产能利用充分、配套体系完善、常住人口规模大、制造业多样性指数和知识复杂性高的城市集聚。

(2) 新能源汽车产业的发展并非凭空而来[41-42],也并未完全抛弃传统汽车制造业领域的技术积累和供应链体系[37]。新能源汽车企业选址时需要充分注意城市在传统汽车制造业领域的积累,更好地将传统汽车制造业的资源优势转换为新能源汽车制造业的发展优势。

(3) 在“电动化、网联化、智能化、共享化”的发展趋势下,汽车正在向移动智能终端、储能空间和数字空间转变[43-44],中国企业积累较少的发动机等汽车机械零部件大幅减少,具有竞争优势的电子信息和电气领域的零部件有所增加[37]。然而,2021年电子和电气产业集聚对中国汽车制造业区位选择的影响未通过显著性检验,中国只有11个城市实现了汽车、电子和电气共同集聚。重庆市、十堰市、长春市、天津市等汽车制造业发达,但并未在电子和电气产业形成专业化优势,需要进一步加快汽车、电子、电气产业融合发展,在汽车产业电动化和智能化领域实现路径突破。

{{custom_citation.url}5}

=2" class="main_content_center_left_zhengwen_bao_erji_title main_content_center_left_one_title" style="font-size: 16px;">{{custom_citation.url}1}{{custom_citationIndex}8}[1]赵福全, 刘宗巍, 郝瀚, 等. 汽车产业变革的特征、趋势与机遇[J]. 汽车安全与节能学报, 2018, 9(3): 233-249.

[

Zhao Fuquan,

Liu Zongwei,

Hao Han, et al. Characteristics, trends and opportunities in changing automotive industry. Journal of Automotive Safety and Energy, 2018, 9(3): 233-249.]

{{custom_citationIndex}6}https://doi.org/{{custom_citationIndex}2}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_ref.citationList}8}{{custom_ref.citationList}4}本文引用 [{{custom_citation.annotation}5}]摘要{{custom_citation.annotation}3}[2]黄剑辉, 李岩玉, 王润. 汽车制造行业研究及风险提示[EB/OL]. 2022-10-01 [2022-12-31]. http://www.sohu.com/a/283256010_618573.

[

Huang Jianhui,

Li Yanyu,

Wang Run, et al. Research and risk warnings in the automotive industry. 2022-10-01 [2022-12-31]. http://www.sohu.com/a/283256010_618573.]

{{custom_citation.annotation}1}0}9}!=''" class="new_full_rich_cankaowenxian_zuozhe new_full_rich_cankaowenxian_lianjie">https://doi.org/{{custom_ref.citedCount>0}7}0}6} && {{custom_ref.citedCount>0}5}!=''" class="new_full_rich_cankaowenxian_zuozhe new_full_rich_cankaowenxian_lianjie">https://www.ncbi.nlm.nih.gov/pubmed/{{custom_ref.citedCount>0}3}0}2} && {{custom_ref.citedCount>0}1}!=''" class="new_full_rich_cankaowenxian_zuozhe new_full_rich_cankaowenxian_lianjie">{{custom_citationIndex}9}本文引用 [{{custom_citationIndex}0}]摘要{{custom_ref.id}8}[3]欧阳铭珂, 张亚斌. 财政补贴、扭曲竞争与汽车产业产能过剩[J]. 财政研究, 2018(12): 84-96, 113.

[

Ouyang Ming-ke,

Zhang Yabin. Fiscal subsidies, distorting competition and overcapacity in the automobile industry. Public Finance Research, 2018(12): 84-96, 113.]

{{custom_ref.id}6}https://doi.org/{{custom_ref.id}2}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_ref.citedCount}8}{{custom_ref.citedCount}4}本文引用 [{{custom_citationIndex}5}]摘要{{custom_ref.citationList}3}[4]徐宁, 李仙德, 李卫江. 中国新创汽车企业退出的空间格局及其影响因素[J]. 地理研究, 2020, 39(10): 2295-2312.

摘要

汽车产业正处于百年一遇的大变革时期。近年来,中国兴起了造车热潮,大量新创企业进入到汽车制造领域。伴随着中国汽车销售市场下行,新创汽车企业持续退出,产生了一定的负面影响。基于微观企业数据库,基于均质背景的核密度分析方法,分析新创汽车企业退出的空间格局;基于非均质背景的核密度分析方法,识别新创汽车企业高退出风险的“热点”区域;运用二值Logit回归方法分析影响新创汽车企业退出的因素。研究发现:① 高进入地区退出的新创汽车企业数量较多,企业退出空间格局整体呈现以长三角为核心的态势;中国沿海和沿长江多个城市退出的新创汽车企业规模较大。② 高退出风险“热点”区域位于江西省抚州市、宜春市、吉安市、山东省烟台市、安徽省池州市、铜陵市等地。③ 相关多样化降低了新创汽车企业的退出概率,非相关多样化增加了企业的退出概率;城市原有的整车产业关联密度越高,整车企业规模越大,新创整车企业退出的概率越低。高全球化水平、高国有工业依赖度、低税收负担率有助于降低新创汽车企业退出概率。

[

Xu Ning,

Li Xiande,

Li Weijiang. The spatial pattern and underlying factors of exited automobile ventures in China. Geographical Research, 2020, 39(10): 2295-2312.]

The global automobile industry has been going through unprecedented and once-a-century changes, which in turn has stimulated new waves of entrepreneurship within the sector. A notable feature of the Chinese automobile industry in recent years is the emergence of new ventures. However, with the decline of automobile sales, many new ventures have exited the market, which generated negative impacts on regional economies. This study uses a detailed firm-level dataset from the "The National Enterprise Credit Information Publicity System" to analyze the spatial pattern of automobile ventures. In particular, it identifies hotspots of new automobile ventures that have ceased to operate with kernel density analysis. Drawing upon the database of "China's Annual Survey of Industrial Firms", this study employs logit regressions to identify underlying factors of exited automobile ventures in China. Specifically, this study finds that: (1) Dynamic entries and exits have been taking place. Areas with more new automobile ventures such as the Yangtze River Delta tend to have more exited firms; exited firms along the coast as well as the Yangtze River tend to be larger. (2) Firms' survival rate varies across regions. "Hotspots" of exited firms include Fuzhou, Yichun, and Ji'an in Jiangxi Province, Yantai in Shandong province, as well as Chizhou and Tongling in Anhui Province. (3) Related variety, which contributes to the generation and diffusion of new "know-how", tends to lower the probability of firm exit, while unrelated variety tends to have the opposite effect. Furthermore, higher levels of relatedness within the sector and larger sizes of the complete automobile industry tend to reduce the probability of firm exit. Higher levels of globalization, which have the potential to bring in new "know-how", tend to be associated with lower probabilities of firm exit. It is also noted that higher levels of dependence on state-owned enterprises as well as lower levels of tax tend to lower the probability of firm exit. Therefore, these results provide further evidence on the importance of industrial policies on firms' survival.

{{custom_ref.citationList}1}https://doi.org/{{custom_ref.bodyP_ids}7}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_ref.bodyP_ids}3}{{custom_ref.id}9}本文引用 [{{custom_ref.id}0}]摘要{{custom_citation.annotation}8}[5]巫细波. 中国汽车制造业生产格局时空演变特征与前景展望[J]. 区域经济评论, 2020(2): 121-129.

[

Wu Xibo. The spatiotemporal evolution of China's automobile manufacturing production pattern and prospects. Regional Economic Review, 2020(2): 121-129.]

{{custom_citation.annotation}6}https://doi.org/{{custom_citation.annotation}2}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.annotation}8}{{custom_citation.annotation}4}本文引用 [{{custom_citation.annotation}5}]摘要{{custom_citation.annotation}3}[6]赵浚竹, 孙铁山, 李国平. 中国汽车制造业集聚与企业区位选择[J]. 地理学报, 2014, 69(6): 850-862.

摘要

本文利用2001-2009 年《中国工业企业数据库》中汽车制造业企业有关数据,对近10 年来中国汽车制造业的空间布局进行描述,利用地理集中度指数和EG指数对产业集聚水平进行测算和分析后,发现中国汽车制造业的空间集聚水平呈现不断下降的趋势,零部件及配件制造业的集聚水平对汽车制造业具有决定性和先导性影响。针对零部件及配件制造业的特点,构建了基于地级以上城市为空间单元的新建企业区位选择模型,进行估计后发现:① 中国不存在类似欧美日等国家整车和零部件企业邻近的空间集中集聚现象;② 零部件制造业的劳动密集型特点显著,不利于产业生产率和专业化水平提高;③ 在不考虑集聚经济的条件下,市场规模和地方保护对新建企业的区位选择影响非常显著。在这些原因的共同作用下,使得中国汽车制造业的专业化水平和空间集聚程度越来越低。

[

Zhao Junzhu,

Sun Tieshan,

Li Guoping. Agglomeration and firm location choice of China's automobile manufacturing industry. Acta Geographica Sinica, 2014, 69(6): 850-862.]

Using the Chinese industrial enterprises database over the period 2001-2009, we analyze the spatial distribution of China's automobile manufacturing industry, by calculating the geographic concentration ratio and the EG index. We find the agglomeration level of China's automobile manufacturing industry has been falling over the period, and the motor vehicle parts manufacturing industry plays an essential role. To analyze the location choice of motor vehicle parts manufacturing start-ups, we build up the conditional logit model using the prefecture level data. The results indicate that: (1) unlike the U.S. and the European countries, the distributions of China's motor vehicle manufacturing firms and motor vehicle parts manufacturing firms are not spatially adjacent, (2) the motor vehicle parts manufacturing startups are labor intensive, which makes the industry's productivity and specialization inefficient, (3) not considering agglomeration economies, the market size and the local protectionism are positive and significant factors that influence the start-ups location choice. Due to all these factors, the specialization and the agglomeration level of China's automobile manufacturing industry is becoming lower.

{{custom_citation.annotation}1}https://doi.org/{{custom_citation.annotation}7}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.annotation}3}{{custom_citation.annotation}9}本文引用 [{{custom_citation.annotation}0}]摘要{{referenceList}8}[7]贺正楚, 王姣, 曹文明. 中国汽车制造业的产业地图及影响产业布局的因素[J]. 科学决策, 2018(5): 1-29.

[

He Zhengchu,

Wang Jiao,

Cao Wenming. Industrial map of China automotive industry and determinants of industrial distribution. Scientific Decision Making, 2018(5): 1-29.]

{{referenceList}6}https://doi.org/{{referenceList}2}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_ref.id}8}{{custom_ref.id}4}本文引用 [{{custom_index}5}]摘要{{custom_ref.nian}3}[8]徐诗燕, 谷人旭, 林柄全, 等. 集聚外部性对企业区位选择影响分析: 基于汽车零部件企业微观数据的实证研究[J]. 世界地理研究, 2019, 28(3): 123-134.

[

Xu Shiyan,

Gu Renxu,

Lin Bingquan, et al. Influence of agglomeration externality on firm location choice: An empirical study based on microdata of auto supplier plants. World Regional Studies, 2019, 28(3): 123-134.]

Using the Chinese industrial enterprises database from 1998 to 2012, we analyze the spatial distribution of China’s auto supplier plants with the calculation results of the EG index. We find an obvious characteristic of China’s auto supplier plants’ agglomeration is along the sea and river although the distribution of enterprises tends to be homogeneous. The space imbalance of new auto supplier plants has a "high - low - high" trend and the areas along the Yangtze River Economic Zone is the hot areas for location choices of auto supplier start-ups. To analyze the location choice of new auto supplier plants, we build up the Poisson regression model based on the prefecture level data. The results indicate that: (1) localization economies is dominated by its own industry, which could significantly increase the possibility of new firms to enter. (2)When the localized economy reaches a certain level, there will be a crowing effect. (3) In addition to the influence of agglomeration externality, the new auto supplier plants are sensitive to land, transportation and domestic market potential factors.

{{custom_ref.nian}1}https://doi.org/{{custom_ref.citedCount}7}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_ref.citedCount}3}{{custom_ref.label}9}本文引用 [{{custom_ref.label}0}]摘要{{custom_citation.content}8}[9]陈肖飞, 韩腾腾, 栾俊婉, 等. 新创企业的时空分异与区位选择: 基于中国汽车制造业的实证研究[J]. 地理研究, 2021, 40(6): 1749-1767.

摘要

新创企业区位选择不仅是企业重要的决策活动,也深刻影响中国制造业地理空间格局演变。在全球化、市场化、分权化背景下,基于“中国工业企业数据库(1998—2012)”和“中国城市统计年鉴(1999—2013)”中新创企业及城市属性数据,采用随机效应面板Tobit模型分析中国汽车制造业新创企业的时空分异与区位选择。研究发现:① 1998—2012年,中国汽车新创企业活跃地区由东部沿海地区向中西部地区转移,尤其是2010—2012年,新创企业呈现向中西部大规模扩散趋势,西部成渝地区逐渐成为新热点区域。② 从新创企业区位选择时空综合机制来看,全球化影响不显著,而市场化和分权化均存在显著影响,其中劳动力、集聚经济、市场潜力与区位商等因素能促使新创企业成立,而国有企业占比则会阻碍新创企业成立。③ 在时间特征差异上,全球化表现不显著,分权化则始终保持对新创企业的显著影响。市场化的劳动力因素影响作用变化说明新创企业区位选择正逐渐从关注劳动力成本转向于关注劳动力质量,而集聚经济和市场潜力在多样化和城市化经济的冲击下作用减弱。④ 在空间特征差异上,全球化的出口因素在东部地区影响显著,但在中西部地区表现不明显,市场化中劳动力因素和市场潜力在东部地区影响不显著,而在中西部地区劳动力因素则显著为正,除此之外,外商直接投资、集聚经济、区位商和国有企业占比对不同区域新创企业区位选择影响大体相同。在经济高质量发展情景下,揭示新创企业时空分异及区位选择机制,强调“区位机会窗口”对某些地区实现企业区位空间调整及其把握企业与政府关系的重要性,不仅能丰富演化经济地理学视角下的企业区位选择的研究,还能更好地理解中国典型区域正在发生的经济转型和空间重构。

[

Chen Xiaofei,

Han Tengteng,

Luan Junwan, et al. Spatiotemporal heterogeneity in the locational choices of new firms in China: A case study of the automobile manufacturing industry. Geographical Research, 2021, 40(6): 1749-1767.]

Location choice is not only a key decision-making for an individual enterprise, but will also exert profound impacts on the spatial pattern of China's manufacturing industry. Under the backdrop of globalization, marketization and decentralization, this study analyzed the spatial heterogeneity in location choice mechanisms of China's automobile manufacturing new entrants, by using China industrial enterprise database (1998-2012) and Tobit econometric model for the random effect. Four key conclusions were obtained. First, China's automobile manufacturing new firms were increasingly attracted to the central and western regions from the eastern coastal areas during 1998-2012. In particular, the Chengdu-Chongqing area experienced large increases in the number of new automobile firms during the study period. Second, in terms of the spatiotemporal location choice mechanisms for new entrants, the impact of globalization was no longer statistically significant, whilst marketization and decentralization forces exerted significant impacts. More specifically, places with better regional labor conditions, higher levels of agglomeration economy, and larger market potentials were associated with higher chances of being selected as destinations for new firms. In contrast, the concentration of state-owned enterprises in a place would hinder the establishment of new firms. Third, we found significant temporal variabilities in how and, the extent to which, different forces affected the location choice of new firms. For instance, decentralization has had significant impacts on the location choices of new firms, the impacts of agglomeration economy and market potential were decreasing with time. In addition, there was a clear shift from labor cost to labor quality in how local labor conditions affect new firms' location choices. Finally, location choice mechanisms for new entrants also varied across regions. The labor conditions and market potential have become much more important in the central and western regions than in the eastern region. The labor conditions and market potential did not have significant impacts in the eastern region, but they played a significant role in the central and western regions. By contrast, FDI, agglomeration economy, and government subsidy policies exerted similar impacts on the location choice of new firms across regions. Through uncovering the spatiotemporal location choice mechanisms for new entrants, this paper highlights the importance of “location opportunity window” theory in understanding the spatial distribution and adjustment of China's industries and the complex relationships between enterprises and local governments, and helps with regional high-quality economic development. By doing so, it enriches the location choice theories of enterprises from the evolutionary economic geography perspective and promotes the understanding of China's economic transformation and spatial reconstruction.

{{custom_citation.content}6}https://doi.org/{{custom_citation.content}2}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.doi}8}{{custom_citation.doi}4}本文引用 [{{custom_citation.doi}5}]摘要{{custom_citation.doi}3}[10]黄娉婷, 张晓平. 京津冀都市圈汽车产业空间布局演化研究[J]. 地理研究, 2014, 33(1): 83-95.

摘要

产业的集聚与扩散所形成的产业结构变迁,带动城市空间发生重构。随着产业不断发展成熟,生产片段化的趋势日益显著,对地区产业链的研究有助于寻求区域空间结构优化的途径。本文基于企业层面的数据,刻画京津冀都市圈汽车制造业企业的空间分布格局,考察汽车企业在都市圈范围内集聚与扩散特点,探讨汽车产业链不同环节的地域特征差异,并分析影响微观企业空间布局的驱动力量。研究结果表明,1996年京津冀都市圈汽车产业集聚程度较低,2001年出现少数集聚中心主导的向心集聚,2010年核心城市与多个新兴集聚点共存;北京的城市功能拓展区和城市发展新区(朝阳、通州、大兴等)、天津市环城4 区(西青、东丽等)以及河北的沧州、廊坊是汽车零部件和配件企业的主要集聚区,而汽车修理企业则倾向于在北京的城市功能拓展区(丰台、朝阳)、天津市内六区和滨海新区以及河北的唐山和石家庄布局。基于条件logit模型的定量研究,验证了市场条件、集聚经济和政策引导等因素是影响京津冀都市圈汽车企业布局的主要因素。

[

Huan Pingting,

Zhang Xiaoping. Spatial evolution of automobile industry in Beijing-Tianjin-Hebei Metropolitan Region. Geographical Research, 2014, 33(1): 83-95.]

A changing industrial structure, which is caused by industrial agglomeration and dispersion, can lead to spatial reconstruction of a city. With the development of the industry, production is becoming fragmented, thus it is helpful to seek ways of optimizing regional spatial structure through researching regional industrial chain. Based on firm-level data, this paper attempts to portray the spatial distribution pattern of automobile manufacture enterprises in Beijing-Tianjin-Hebei Metropolitan Region, to find out the agglomeration and dispersion characteristics of these enterprises in this region, to explore geographical differences among different sessions of the automotive industry and to analyze the driving forces of the micro-enterprise spatial pattern. The research results show that the agglomeration degree of auto industry was low in 1996; In 2001, two agglomeration centers emerged and such tendency has been reinforced in 2010, with the emergence of a few new cores. Auto parts and accessories manufacturing were mostly distributed at urban function extended districts and urban development zones (Chaoyang, Tongzhou, Daxing, etc.) of Beijing, suburban areas (Xiqing, Dongli, etc.) of Tianjin and Cangzhou, Lanfang of Hebei province as well. While for automobile maintenance firms, urban functional development areas (Fengtai, Chaoyang) in Beijing, the six urban districts and Binhai New Area of Tianjin, and Tangshan and Shijiazhuang in Hebei province are their main areas of agglomeration. Through quantitative research based on conditional logit model, market conditions, agglomeration economies and policy guidance are proven to be possible factors affecting the distribution of auto firms.

{{custom_citation.doi}1}https://doi.org/{{custom_citation.doi}7}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.doi}3}{{custom_citation.pmid}9}本文引用 [{{custom_citation.pmid}0}]摘要{{custom_citation.pmid}8}[11]李佳洺, 孙威, 张文忠. 北京典型行业微区位选址比较研究: 以北京企业管理服务业和汽车制造业为例[J]. 地理研究, 2018, 37(12): 2541-2553.

摘要

以微观企业数据为基础,采用核密度空间平滑和条件逻辑选择模型等方法,重点关注企业在城市内部微观尺度下的区位选择,并对北京典型现代服务业和制造业区位选择的差异进行对比分析。结果表明:① 北京中小型制造企业倾向于在集聚区分布,符合马歇尔式产业集群的特征,而服务业则是大型企业更倾向于集中布局;② 尽管微观尺度下多样化和上下游产业链对现代服务业和制造业依然有重要影响,但是与宏观尺度下不同的是对于现代服务业来说过度多样化并不利于其发展,对于制造业来说区域专业化劳动力规模而非专业化程度更为重要;③ 政府对地铁等公共设施布局选址将对现代服务业的微观区位产生重要影响。

[

Li Jiaming,

Sun Wei,

Zhang Wenzhong. Comparative study on micro-scale location choice of typical industries: The case study of management service and automobile manufacturing in Beijing. Geographical Research, 2018, 37(12): 2541-2553.]

Industrial location has attracted much attention since classical location theories were built, but most of literature focused on location choice at macro scale. However, micro-scale location choice became a troublesome problem due to the reduction of land and the increase of land price. The research employed a unique micro-firm dataset to identify industrial agglomeration areas of service and manufacturing industries in Beijing and then uncovered factors which have impact on micro-scale location choice within urban areas. Importantly, the result further showed difference of location choice between two typical economic sectors--management service and automobile manufacturing in Beijing. The findings are obtained as follows: (1) 102 service and 130 manufacturing agglomeration areas were identified by firm and employment densities. Firms within these two kinds of agglomeration areas accounted for 72.66% and 44% in service and manufacturing industries respectively. Generally, most of large service firms had concentrated into those service clusters, while large manufacturing enterprises used to be located otherwise. Compared with large firms, small and medium-sized manufacturing firms were more inclined to distribute in agglomeration areas. (2) Although the results showed that urbanization economies had significant effect on location choice of both modern service (representing by management service) and manufacturing industry (representing by automobile manufacturing), the influence mechanisms are completely different. The former prefers a diversified local labor market and relatively diversified industrial environment, while the latter needs a complete industry supplying chain. It is only because the automobile industry has a diverse and comprehensive range of auto parts, it seems that automobile manufacturing firms prefer diversified environment. Naturally, upstream and downstream industry chains and specialized labors are key factors for location choice of automobile firms. Even for the service industry, it is not the more diversified the better at the micro scale. (3) Different from existing literature, the results showed that industrial policies had more influence on service than manufacturing industry. It is partly because one of important factors for location of management service is public infrastructure such as subway, on which local governments have enough impact; and partly because, automobile, as an advanced manufacturing industry, is not among the negative list of manufacturing. Besides, enterprise property has significant influence on location choice of both industries.

{{custom_citation.pmid}6}https://doi.org/{{custom_citation.pmid}2}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}8}{{custom_citation.pmid}4}本文引用 [{{custom_citation.url}5}]摘要{{custom_citation.url}3}[12]胡森林, 滕堂伟, 袁华锡, 等. 长三角城市群汽车企业空间集聚与发展绩效[J]. 长江流域资源与环境, 2019, 28(4): 747-756.

[

Hu Senlin,

Teng Tangwei,

Yuan Huaxi, et al. Spatial agglomeration and development performance of automobile enterprises in Yangtze River Delta urban agglomeration. Resources and Environment in the Yangtze Basin, 2019, 28(4): 747-756.]

{{custom_citation.url}1}https://doi.org/{{custom_citation.url}7}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.url}3}{{custom_citation.url}9}本文引用 [{{custom_citation.url}0}]摘要{{custom_ref.citationList}8}[13]孙威, 林晓娜. 柳州市汽车制造业企业的空间格局与影响因素[J]. 地球信息科学学报, 2020, 22(6): 1216-1227.

摘要

中国是世界汽车生产大国,产销量已连续9年蝉联世界第一,然而有关汽车产业的研究更多集中在区域尺度,对城市尺度的研究相对较少。本文以柳州市为案例,利用工商注册企业数据和核密度估计、负二项回归模型等方法分析了柳州市汽车制造业企业的空间格局与影响因素。结果表明:① 汽车制造业企业主要集中在河西、洛维、河东、阳和等城市组团,企业集聚范围逐步向东、向西扩散,其中向东扩散以柳东新区为主,向西扩散以河西高新技术产业开发区为主;② 汽车制造业企业在距离市中心0~11 km显著集聚,空间集聚强度呈现先增加后减小的趋势;③ 土地价格、交通条件、地方化经济、政策是影响汽车制造业企业区位选择和空间格局的重要因素;同时,汽车制造业JIT(Justin Time)生产方式也具有重要影响。在此基础上,提出汽车制造业企业区位选择和空间格局形成的循环累积机制、区位临近机制、价格传导机制。

[

Sun Wei,

Lin Xiaona. The spatial distribution of automobile manufacturing enterprises and its influencing factors in Liuzhou. Journal of Geo-information Science, 2020, 22(6): 1216-1227.]

{{custom_ref.citationList}6}https://doi.org/{{custom_ref.citationList}2}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.annotation}8}{{custom_citation.annotation}4}本文引用 [{{custom_citation.annotation}5}]0}9} && {{custom_ref.citedCount>0}8}!=''" style="color: #666;">摘要0}7} && {{custom_ref.citedCount>0}6}!=''" class="glyphicon glyphicon-triangle-bottom biaotijiantoush biaotijiantoush1" onclick="ckwx_show_hide(this)">0}5} && {{custom_ref.citedCount>0}4}!=''" class="mag_main_zhengwen_left_div_ckwx_table_ckwx_xiangqing">{{custom_ref.citedCount>0}3}[14]贺正楚, 王姣, 吴敬静, 等. 中国汽车制造业产能和产量的地域分布[J]. 经济地理, 2018, 38(10): 118-126.

[

He Zhengchu,

Wang Jiao,

Wu Jingjing, et al. Industrial map and industrial layout of China's automobile manufacturing industry. Economic Geography, 2018, 38(10): 118-126.]

0}2}" m-for-val="custom_citation" m-for-index="custom_citationIndex">{{custom_ref.citedCount>0}1}0}0} && {{custom_citationIndex}9}!=''" class="new_full_rich_cankaowenxian_zuozhe new_full_rich_cankaowenxian_lianjie">https://doi.org/{{custom_citationIndex}7}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citationIndex}3}{{custom_ref.citationList}9}本文引用 [{{custom_ref.citationList}0}]摘要{{custom_ref.citedCount}8}[15]巫细波. 外资主导下的汽车制造业空间分布特征及其影响因素: 以广州为例[J]. 经济地理, 2019, 39(7): 119-128.

[

Wu Xibo. Spatial distribution evolvement characteristics and influencing factors of automobile manufacturing industry under the guidance of foreign investment: A case study of Guangzhou. Economic Geography, 2019, 39(7): 119-128.]

{{custom_ref.citedCount}6}https://doi.org/{{custom_ref.citedCount}2}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citationIndex}8}{{custom_citationIndex}4}本文引用 [{{custom_ref.citationList}5}]摘要{{custom_ref.bodyP_ids}3}[16]张永凯, 徐伟. 演化经济地理学视角下的产业空间演化及其影响因素分析: 以中国汽车工业为例[J]. 世界地理研究, 2014, 23(2): 1-13, 25.

[

Zhang Yongkai,

Xu Wei. Analysis of the industry spatial evolution mechanism and its determinants from the perspective of evolutionary economic geography: A case study of China's automobile industry. World Regional Studies, 2014, 23(2): 1-13, 25.]

{{custom_ref.bodyP_ids}1}https://doi.org/{{custom_ref.id}7}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_ref.id}3}{{custom_bodyP_id}9}本文引用 [{{custom_bodyP_id}0}]摘要{{custom_citation.annotation}8}[17]朱晟君, 金文纨, 胡晓辉. 关联视角下的区域产业动态研究进展与反思[J]. 地理研究, 2020, 39(5): 1045-1055.

摘要

区域产业动态是经济地理学的经典研究主题。不同尺度的传统经济地理研究常以企业、产业和区域为研究对象,忽略了不同个体之间的关联。近年来,经济地理学增加了关于企业关联的研究,但对于产业关联和区域关联的关注仍显不足。基于关联视角,本文首先围绕产业关联和区域关联等概念探讨了关联的形成机制,进一步梳理关于产业关联、区域关联与区域产业动态的研究进展,并为未来区域产业动态研究提出相关建议。与企业关联相同,产业和区域关联也与个体间的要素流动有关。现有研究表明产业关联有助于揭示区域产业演化规律,而区域关联会通过区域间要素流动影响区域产业动态。关联视角是区域产业动态研究的新视角,具有较大的研究潜力,值得引起经济地理学者们的关注。

[

Zhu Shengjun,

Jin Wenwan,

Hu Xiaohui. The regional industrial dynamics from the perspective of relatedness. Geographical Research, 2020, 39(5): 1045-1055.]

Chinese economic development has experienced a rapid transformation since 1978 due to the implementation of the reform and opening-up policy. Arguably the research of regional industry dynamics is at the core of economic geography. Traditional researches in economic geography tend to focus on individuals such as firms, industries and regions, ignoring the relationship between them. Over the past few years, much progress has been made in researches on the relatedness of firms, while the relatedness of industries and regions is still not paid sufficient attentions. From the perspective of relatedness, this paper attempts to shed some light on the linkages of industries and regions, and explore their formation mechanisms. It puts forward that the translocal linkages and resource mobilization on different scales are sources of the relatedness of firms, industries and regions. In addition, this paper also sketches out how industrial relatedness and regional relatedness influences regional industrial dynamics. As for industrial relatedness, evolutionary economic geography (EEG) theories based on a network model named the "product space" have adopted a view that regional spillovers from related, yet not too proximate industries will endogenously induce new industries in a region through processes of recombinatorial innovation. The vast majority of empirical case studies have confirmed these theories. Regional industrial dynamics has thus far largely been conceptualized as an endogenous process, underplaying exogenously-driven forms of regional relatedness. Then, this paper provides a systematic conceptual analysis of the role regional relatedness may play for industrial dynamics in regions. Good connections between the regions improve matching on labour markets, speeding up knowledge flows and plausibly fostering learning which will contribute to the reciprocal industrial dynamics of geographically distant regions. Accordingly, this paper argues that future studies can further investigate the regional development from a relatedness perspective: (1) pay more attention to the industrial relatedness, such as its indirect links, link strengths and industrial relatedness dynamics; (2) enhance the understanding of the properties of regional relatedness and draw on network analysis approaches; (3) forge a link between industrial relatedness and regional relatedness. Emanated from different disciplines, the new perspective of relatedness in the study of regional industry dynamics provides a sound basis for understanding China's special development path and deserves the attention of economic geography scholars. Besides, there is rapidly expanding various data of relatedness which will make the perspective of relatedness more potential in the future.

{{custom_citation.annotation}6}https://doi.org/{{custom_citation.annotation}2}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.annotation}8}{{custom_citation.annotation}4}本文引用 [{{custom_citation.annotation}5}]摘要{{custom_citation.annotation}3}[18]金璐璐, 贺灿飞, 周沂, 等. 中国区域产业结构演化的路径突破[J]. 地理科学进展, 2017, 36(8): 974-985.

摘要

在经济转型新阶段,如何突破已有资源条件的束缚,创造新的产业发展路径是区域经济增长的突破口。路径依赖和路径突破是区域创造产业发展路径的两种途径,已有演化经济地理学研究证实区域生产结构的演化依赖地区已有生产能力,是一种路径依赖的结果,而谁是突破区域现有生产能力实现新路径创造的开拓者却尚未得知。本文基于1999-2012年中国337个地级城市的424个四位数产业数据,沿用Hidalgo等人对生产能力的定义,研究中国产业演化过程中路径突破的可能,结果发现:地区新产业的进入以及已有产业的退出有助于地区突破对原有生产结构的依赖,是区域产业发展新路径的创造者。政府补贴一方面有利于地区现有生产能力的提升,增强地区路径依赖趋势;另一方面可为地区带来新的路径,实现路径突破并为区域创造新的发展机会。此外,政府补贴影响产业演化路径选择的效用受地方财政能力限制,并在空间上存在显著差异。

[

Jin Lulu,

He Canfei,

Zhou Yi, et al. Path creation in China's industrial evolution. Progress in Geography, 2017, 36(8): 974-985.]

In evolutionary economics, the notion of path creation has attracted much attention in recent years. Previous research has expounded the possibility of path dependence and path creation in the process of regional industrial evolution, but it remains unknown that who changes the existing production capacity and accomplishes path creation. This article focuses on regional production capacity, and applies the indicator of density defined by Hidalgo. Based on the data of 424 four-digit industry of 337 prefecture-level cities in China from 1999 to 2012, this article discusses the path creation of China's industrial evolution. It is found that the entry and exit of an industry would break the original production structure of a region and become the creator of a new path. Governmental subsidies, on the one hand, can promote the development of a region's existing production capacity to enhance the regional's path dependence trend, but also can influence industry dynamics and accelerate the process of path creation. The selection of evolutionary path has significant regional differences. This study will help deepen the understanding of the change of China's industrial structure and its regional differentiation, and provides new evidence from developing countries for the development of evolutionary economic geography.

{{custom_citation.annotation}1}https://doi.org/{{custom_citation.annotation}7}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.annotation}3}{{custom_citation.annotation}9}本文引用 [{{custom_citation.annotation}0}]摘要{{custom_ack.title_cn}8}[19]贺灿飞. 演化经济地理研究[M]. 北京: 经济科学出版社, 2018.

[

He Canfei. Evolutionary economic geography research. Beijing, China: Economic Science Press, 2018.]

{{custom_ack.title_cn}6}https://doi.org/{{custom_ack.title_cn}2}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_ack.title_cn.length>0}8}0}7} && {{custom_ack.title_cn.length>0}6}!=''" class="new_full_rich_cankaowenxian_zuozhe new_full_rich_cankaowenxian_lianjie">{{custom_ack.title_cn.length>0}4}0}3}=={{custom_ack.title_cn.length>0}2}.length-1) || ({{custom_ack.title_cn.length>0}1} && {{custom_ack.title_cn.length>0}0}!='')" class="mag_main_zhengwen_left_div_ckwx_table_benwenyiny mag_rich_ref_abstract">本文引用 [{{custom_ack.title_cn}5}]摘要{{custom_ack.content}3}[20]Hidalgo C A. Economic complexity theory and applications[J]. Nature Reviews Physics, 2021, 3: 92-113.

{{custom_ack.content}1}https://doi.org/{{fundList_cn}7}https://www.ncbi.nlm.nih.gov/pubmed/{{fundList_cn}3}{{custom_fund}9}本文引用 [{{custom_fund}0}]摘要{{custom_citation.annotation}}[21]任卓然, 贺灿飞, 王文宇. 演化经济地理视角下的经济复杂度与区域经济发展研究进展[J]. 地理科学进展, 2021, 40(12): 2101-2115.

摘要

经济复杂度是近年来演化经济地理学的重要议题之一,其关注产业结构转型和内生增长路径,有助于理解区域经济结构转型过程,对经济地理学、发展经济学等理论深化具有重要作用。论文介绍了经济复杂度的理论背景,梳理了演化经济地理视角下经济复杂度的内涵、概念及理论框架,在此基础上回顾了经济复杂度的主流测度方法,并基于产业多样化与产品空间理论探究了经济复杂度与区域经济发展的作用机制,进而回顾了经济复杂度对区域经济增长、区域收入差异和创新等方面的实证研究进展,发现绝大多数文献证明了经济复杂度对区域经济发展的积极作用。区域可以从提升产品空间密度的思路出发,通过提升产业生产和创新能力促进区域经济复杂度提升。中国经济复杂度高于相同收入水平的其他国家,发展路径具有一定特殊性,这为经济复杂度理论研究提供了案例,且在实践中具有较强的政策含义。

[

Ren Zhuoran,

He Canfei,

Wang Wenyu. Progress of research on economic complexity and regional economic development in the perspective of evolutionary economic geography. Progress in Geography, 2021, 40(12): 2101-2115.]

Economic complexity is one of the important topics in evolutionary economic geography in recent years. Its attention to the transformation of industrial structure and the path of endogenous growth plays an important role in deepening the theories of economic geography and development economics, and helps to understand the transformation process of regional economic structure. This article reviewed the theoretical background of economic complexity, and examined the connotation, concept, and theoretical framework of economic complexity from the perspective of evolutionary economic geography. Then it reviewed the mainstream measurement methods of economic complexity. Based on the theory of diversification and product space, this article explored the mechanism of economic complexity on regional economic development, and then reviewed the progress of empirical research of economic complexity on regional economic growth, regional income disparity, and innovation. We found that most of the literature has proved the positive effect of economic complexity on regional economic development. Based on the idea of improving the product space density, regional economic complexity can be promoted by improving the industrial capacity and innovation ability. China's economic complexity is higher than that of other countries at the same income level, and its development path has unique characteristics, which provides a case for the theoretical study of economic complexity and has strong policy implications.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[22]Balland P A,

Broekel T,

Diodato D, et al. The new paradigm of economic complexity[J]. Research Policy, 2022, 51(3): 104450. doi: 10.1016/j.respol.2021.104450.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[23]张华, 梁进社. 产业空间集聚及其效应的研究进展[J]. 地理科学进展, 2007, 26(2): 14-24.

[

Zhang Hua,

Liang Jinshe. Progress in industrial agglomeration research. Progress in geography, 2007, 26(2): 14-24.]

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[24]贺灿飞, 刘洋. 产业地理集中研究进展[J]. 地理科学进展, 2006, 25(2): 59-69.

[

He Canfei,

Liu Yang. A literature review on geographical concentration of industries. Progress in Geography, 2006, 25(2): 59-69.]

The geographical concentration of employments and establishments is pervasive. Companies and plants are not distributed uniformly in space, but rather agglomerate in some places. Both location theories and trade theories could be applied to explain the geographical concentration of industries. Classical and neoclassical location theories emphasize the role of transportation costs, labor costs, demand and locational interdependence in promoting spatial clustering of industries. Behavioralists stress the importance of uncertainties, information and knowledge. Strategic perspectives highlight the strategic interactions between related economic agents in locational decisions. Structural location theories relate industrial locations to industrial organization and industrial linkages. In the existing theoretical literature, three broad families of trade models are related to geographic concentration: the neoclassical trade models, new trade models and new economic geography models. In the neoclassical trade theories, the spatial pattern is formed through inter-industry specialization with industries settling in locations with comparative advantages. New trade models are characterized by increasing returns to scale, product differentiation and monopolistic competition. Scale economies provide regions with incentives to specialize even in the absence of differences in their technology or resoure endowments, and make firms to concentrate their production in a few locations. In the new economic geography models, the distribution of economic activities becomes entirely endoenous. Geographic concentration is driven by the interaction of transportation costs and scale economies, which creates demand and cost linkages. Empirical studies on geographical concentration of industries confirm a variety of significant variables including resource endowment, market demand, internal scale economies, external economies, industrial linkages and trade liberalization.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[25]刘作丽, 贺灿飞. 集聚经济、制度约束与汽车产业跨国公司在华功能区位[J]. 地理研究, 2011, 30(9): 1606-1620.

[

Liu Zuoli,

He Canfei. Agglomeration, institutions and the functional location of auto TNCs in China. Geographical Research, 2011, 30(9): 1606-1620.]

In the new millennium, the global economic map is more complicated at present than that only a few decades ago. Through the actions and interactions of transnational corporations (TNCs) and states within a volatile technological environment, the simple international division of labor between industries has been replaced by the more complicated new international division of labor across activities. Within a host economy, TNCs may be distributed with different types of activities or functions in different locations to fully exploit the comparative and institutional advantages. This study examined the functional location of auto TNCs in China based on the Fortune 500 TNCs data. It is shown that different functions of auto TNCs in China have different spatial patterns. The service functions tend to be concentrated in large cities, mainly in Beijing and Shanghai, while production facilities prefer to be agglomerated in specialized cities, such as Shanghai, Tianjin, Chongqing and Guangzhou. Results from the conditional logit model indicate that agglomeration and institutions undermine the locational choices of auto TNCs' functions. Production facilities favor cities which can easily acquire specialized labor and components and parts suppliers while service functions are significantly attracted to cities with functional agglomeration. Production facilities are located in the places which allow them to acquire partners while service functions tend to be concentrated in the places where the policy is made.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[26]张翼鸥, 谷人旭. 中国城市知识复杂性的空间特征及影响研究[J]. 地理学报, 2018, 73(8): 1421-1432.

摘要

学者和政策制定者一致认为“知识”是推动经济长期增长的关键因素之一,且并非所有知识都具有相同价值。然而,经济地理学一直致力于计量知识的投入和产出,而忽视评估知识质量。为此,首先借鉴Hidalgo等的“双峰网络模型”构建了知识复杂性的测度模型,并根据中国知识产权局1986-2015年间的14349355条专利记录,依照122项专利分类识别中国城市的技术结构。将中国城市知识复杂性的分布、集聚特征和演化过程地图化,以探索知识的空间分布及其复杂性的关联。结果表明:① 具有最复杂技术结构的城市未必是那些专利申请率最高的城市,说明强调知识的数量与质量并重,有助于科学衡量中国知识的生产格局;② 知识复杂性在中国呈不均匀分布,其空间集聚显著,演化过程显示热点区域“南下”态势明显;③ 专利转移数据进一步证明,知识复杂性越高的城市,其知识的空间粘性越大,越不易流动,因此将区域知识结构从低复杂度转化为高复杂度将有助于地区重塑自身优势。

[

Zhang Yi'ou,

Gu Renxu. The geography of knowledge complexity and its influence in Chinese cities. Acta Geographica Sinica, 2018, 73(8): 1421-1432.]

Knowledge is one of the key drivers of long-term economic growth. Additionally, it is widely accepted that not all knowledge has the same value. Nevertheless, too often in the field of economic geography and cognate, we have been obsessed with counting knowledge inputs and outputs rather than assessing the quality of knowledge produced. To fill this gap, this article focuses on the knowledge complexity and its significant role in regional innovation. To begin with, based on the "bimodal network models" of Hidalgo and Hausmann, designed to measure the complexity of knowledge, the article investigates 14349355 pieces of patent records from the State Intellectual Property Office of P.R.China to identify the technological structure of Chinese cities in terms of the patent classes between 1986 and 2015. Furthermore, the article explores the evolution of knowledge complexity in Chinese cities and how the spatial diffusion of knowledge is linked to complexity using visualizing tools such as Gephi and ArcGIS. The results show that: (1) The cities with the most complex technological structures are not necessarily those with the highest rates of patenting, which suggests that the emphasis on both quality and quantity will definitely contribute to a better understanding of the distribution of knowledge production in China; (2) Knowledge complexity is unevenly distributed across China and the evolution process shows that the hot spots are obviously southward, indicating the characteristics of geographical agglomeration and the great differences between zones; (3) More complex patents are less likely to be transferred than those with less complexity in terms of the data of patent transference and the pattern is also verified by correlational analysis, Linear Probability Model and logistic regression approach of STATA. Therefore, upgrading regional knowledge structure from low complexity to high complexity will contribute to reshaping regional advantages respectively.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[27]竹内淳彦. 日本における自動車工業の地域的構造[J]. 地理学評論, 1971, 44(7): 479-497.

[

Takeuchi A. The areal structure of the automobile industry in Japan. Geographical Review of Japan, 1971, 44(7): 479-497.]

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[28]Boschma R A,

Wenting R. The spatial evolution of the British automobile industry: Does location matter?[J]. Industrial and Corporate Change, 2007, 16(2): 213-238.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[29]Enrietti A,

Geuna A,

Nava C R, et al. The birth and development of the Italian automotive industry (1894-2015) and the Turin car cluster[J]. Industrial and Corporate Change, 2022, 31(1): 161-185.

This paper describes the early genesis and later evolution of the Italian automotive industry employing the traditional agglomeration approach combined with Klepper’s spinoff theory. It highlights the key role played by the Turin car cluster from the late 19th century. We provide the first comprehensive database of Italian automobile companies from 1894 until 2015, based on original archival research. We use historical analysis and econometric models to identify the factors contributing to the creation and success of the automotive industry in Turin. More specifically, we investigate agglomeration economies and the part played by spinoffs and institutional factors with a special emphasis on the role of local education. Our model confirms the existence of a spinoff effect and, especially, the positive effect of inherited technical skills embedded in pilots. We find support for positive agglomeration effects at the regional level, technological complementarities with aeronautics, a metropolitan cluster effect, and importance of local education. Basic and technical education seem to be particularly important initial institutional preconditions for further technical learning and scientific advancement and would make an interesting research topic.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[30]Teece D J. China and the reshaping of the auto industry: A dynamic capabilities perspective[J]. Management and Organization Review, 2019, 15(1): 177-199.

Chinese firms are grappling with the four paradigm shifts around electric, connected, shared, and autonomous vehicles that are roiling the rest of the global auto industry. This article, which follows my earlier MOR article about the auto industry (Teece, 2018a), looks briefly at the development of capabilities in these fields by Chinese firms. It then analyzes the prospects for Chinese firms to use them to gain a stronger foothold in the global market, and for multinationals to continue to prosper in China. The paradigm shifts are creating new entry points for Chinese firms to capture value in the industry, and some potential global contenders have demonstrated solid dynamic capabilities in electric vehicles (Geely), shared vehicles (Didi Chuxing), and autonomous vehicles (Baidu). However, multinationals are also moving forward in the same fields and have strong complementary assets such as respected brands and well-honed dynamic capabilities.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[31]Frenken K,

Van Oort F,

Verburg T. Related variety, unrelated variety and regional economic growth[J]. Regional Studies, 2007, 41(5): 685-697.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[32]Liu W D,

Dicken P. Transnational corporations and 'obligated embeddedness': Foreign direct investment in China's automobile industry[J]. Environment and Planning A: Economy and Space, 2006, 38(7): 1229-1247.

With the aid of an empirical case study of the automobile industry in China, we explore how, under certain political–economic conditions, the investments of transnational corporations (TNCs) can be shaped to meet the state's objectives. We develop the concept of ‘obligated embeddedness’ to capture the dynamics of this process. We show that foreign direct investment in the automobile industry in China is a type of market-led and embedded investment which is characterised by joint ventures and the follow-up network configurations. However, to achieve such obligated embeddedness on the part of TNCs—and for the state and its citizens to gain its benefits—the state not only has to have the theoretical capacity to control access to assets located within its territory, but also the power actually to determine such access.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[33]毕秀晶, 汪明峰, 李健, 等. 上海大都市区软件产业空间集聚与郊区化[J]. 地理学报, 2011, 66(12): 1682-1694.

[

Bi Xiujing,

Wang Mingfeng,

Li Jian, et al. Agglomeration and suburbanization: A study on the spatial distribution of software industry and its evolution in metropolitan Shanghai. Acta Geographica Sinica, 2011, 66(12): 1682-1694.]

Due to the continuing global economic integration, global cities are increasingly becoming the nodes of command function and the sites of knowledge and innovation production. In China, ICT sectors including software industry started to cluster in major metropolitan areas since the 1990s, and have become the driving engine of the economy. However, the distribution of software industry is spatially uneven, and spatial factors significantly influence its location decision. Although lots of scholars have focused on this phenomenon and analyzed the spatial pattern of software industry in developed countries, little attention has been paid to metropolitans in China. There is a need to explore how the software firms are distributed in Chinese metropolitans in the transformation period. In this paper, we attempt to discuss the spatial distribution of software firms in Shanghai. We select the information of software firms in the years 2002 and 2008 as our basic dataset to compare the difference of the spatial pattern in different years and explore their mechanism with the aid of GIS. The result shows that agglomeration and suburbanization are dominant characteristics in the distribution of software industry in Shanghai. During the process of suburbanization, we find firms in different types, different scales, and different ownership can lead to different locational decisions. The suburbanization of small firms is more obvious. Based on the empirical analysis, accessibility, politics and the previous distribution pattern have a significant effect on the spatial evolution of software industry in metropolitan Shanghai.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[34]邓向荣, 曹红. 产业升级路径选择: 遵循抑或偏离比较优势: 基于产品空间结构的实证分析[J]. 中国工业经济, 2016(2): 52-67.

[

Deng Xiangrong,

Cao Hong. Industrial upgrading path: Conform or defy comparative advantage: An empirical analysis based on product space structure. China Industrial Economics, 2016(2): 52-67.]

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[35]湖北省经济和信息化厅. 湖北省汽车工业发展“十四五”发展规划[EB/OL]. 2021-12-31 [2022-10-03]. http://jxw.huangshi.gov.cn/cyks/zbzzcyk/zbgzkwjfb/202204/P020220427622235271935.pdf.

[Hubei Provincial Department of Economy and Information Technology. Hubei Province's "14th Five-Year Plan" for the development of the automobile industry. 2021-12-31 [2022-10-03]. http://jxw.huangshi.gov.cn/cyks/zbzzcyk/zbgzkwjfb/202204/P020220427622235271935.pdf.]

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[36]白麟. 重庆新能源汽车发展高端访谈: 传统汽车强市能否成为新能源汽车强市?访重庆大学机械与运载工程学院教授郭钢[N/OL]. 重庆日报, 2022-07-11 [2022-10-03]. https://baijiahao.baidu.com/s?id=1737965638067748694&wfr=spider&for=pc.

[

Bai Lin. Chongqing's development of new energy vehicles: Can a strong city in traditional automobiles become a strong city in new energy vehicles? Interview with Professor Guo Gang from the School of Mechanical and Transportation Engineering, Chongqing University. Chongqing Daily, 2022-07-11 [2022-10-03]. https://baijiahao.baidu.com/s?id=1737965638067748694&wfr=spider&for=pc.]

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[37]苑志佳. 中国電気自動車(EV)産業の競争優位に関する分析 ― マーケット·セグメント·カバレージと サプライチェインを中心に[J]. 経済学季報, 2023, 72(4): 1-35.

[

Yuan Zhijia. Analysis of competitive advantage in China's electric vehicle (EV) industry: Focusing on market segmentation coverage and supply chain. Journal of Economics, 2023, 72(4): 1-35.]

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[38]沈浩. 定了! 上汽乘用车第四大基地落子福建宁德[N/OL]. 上海汽车报, 2018-05-04 [2022-10-03]. http://www.shautonews.com/web/2618.htm.

[

Shen Hao. Confirmed! SAIC Motor's fourth major manufacturing base settles in Ningde, Fujian. Shanghai Automotive News, 2018-05-04 [2022-10-03]. http://www.shautonews.com/web/2618.htm.]

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[39]贺灿飞. 区域产业发展演化: 路径依赖还是路径创造?[J]. 地理研究, 2018, 37(7): 1253-1267.

摘要

区域发展是区域产业不断演化、转型与升级的过程。近年来发展起来的演化经济地理学旨在通过分析企业进入、成长、衰退和退出等动态过程阐释企业、产业、集群、网络、城市和区域的空间演化,认为区域产业发展演化遵循路径依赖,并决定于产业技术关联。然而路径依赖式演化理论过于强调内生发展过程,忽视了外生因素和制度变革带来的路径创造机会。中国处于经济转型时期,区域产业结构变动剧烈。技术关联推动了区域产业演化,显示中国区域产业演化具有路径依赖性,同时市场化、全球化和分权化的经济转型过程为区域产业发展创造了新路径。外部联系、制度安排、行为主体的战略性行为等促进了路径创造。

[

He Canfei. Regional industrial development and evolution: Path dependence or path creation? Geographical Research, 2018, 37(7): 1253-1267.]

Regional development is a process in which industries develop, transform and upgrade constantly. Evolutionary economic geography understands the spatial evolution of firm, industry, cluster, network, city and region through the lens of firm entry, growth and exit, and argues that regional industrial evolution is path dependent and determined by inter-industrial technological relatedness. However, path dependence theory overemphasizes the endogenous factors in regional industrial development and ignores the critical role of external linkages and institutional factors, which would bring path creation for regional development. In China, there has been dramatic transformation in regional industrial structure since the economic reform. Empirical studies indicate that technological relatedness has indeed significantly determined regional industrial evolution, suggesting a path dependent process. Meanwhile, marketization, globalization and regional decentralization provide great opportunities to create new industries for regional development. In particular, external linkage, institutional factors and purposeful and strategic actions of local actors would stimulate path creation.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[40]王凤英. 推动中国汽车工业产能利用率提升的建议[EB/OL]. 2022-03-04 [2022-10-03]. http://field.10jqka.com.cn/20220304/c637197687.shtml.

[

Wang Fengying. Recommendations for promoting the improvement of capacity utilization in China's automotive industry. 2022-03-04 [2022-10-03]. http://field.10jqka.com.cn/20220304/c637197687.shtml.]

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[41]Ferloni A. Transitions as a coevolutionary process: The urban emergence of electric vehicle inventions[J]. Environmental Innovation and Societal Transitions, 2022, 44: 205-225.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[42]张凯煌, 千庆兰. 中国新能源汽车产业创新网络特征及其多维邻近性成因[J]. 地理研究, 2021, 40(8): 2170-2187.

摘要

随着知识经济的发展和创新驱动发展战略的实施,创新网络及其多维邻近性机制已成为政府和学者共同关注的焦点。利用Ucinet软件,从区域、主体性质等维度,刻画了2009—2014年产业快速发展时期的中国新能源汽车专利创新网络特征。运用PLS-SEM模型,探究全国及不同区域创新网络的多维邻近性影响过程及原因。研究发现:① 与中国新能源汽车产业创新活动集中在大城市和三大城市群不同,其合作创新网络主要集聚在京津冀与长三角地区,珠三角地区的创新网络明显较弱。同时,创新能力欠发达的区域出现了与其数量不匹配的合作创新规模。② 总的来看,全国创新网络呈现“核心-边缘”结构,国家电网是网络中最重要的创新主体。在京津冀,大型国企集团控制网络,“核心-边缘”结构突出,合作创新最活跃,网络外向程度高。在长三角,区域内主体类型混合多样,“核心-边缘”结构突出,合作创新活跃,网络外向程度较高。在珠三角,民营企业是网络的主要主体,区域网络结构松散,合作创新活跃度低,网络外向程度高。③ 从创新网络的多维邻近性成因看,在全国尺度,组织关系与知识搜寻是全国网络形成的两大动力。在京津冀,国电集团强有力推动跨区域网络形成。在长三角,国电系及区域大企业影响网络形成,丰富的知识源推动合作创新发生。在珠三角,地理邻近性对民营企业合作创新影响有限,知识需求推动了跨区域合作。

[

Zhang Kaihuang,

Qian Qinglan. Characteristics and proximities mechanism of China's new energy vehicle industry innovation network. Geographical Research, 2021, 40(8): 2170-2187.]

In the context of the knowledge-based economy and innovation-driven development strategy, innovation networks and their multidimensional proximity mechanisms have attracted increasing attention from governments and economic geographers. However, knowledge about their regional differences remains limited. Using Ucinet software, the authors describe the technological innovation network characteristics of the new energy vehicle (NEV) industry in China from 2009 to 2014, which corresponds to the period of rapid development of vehicle ownership. The authors use partial least squares structure equation modelling to explore the impacts of multidimensional proximities from national and regional perspectives. The study found that: (1) Unlike innovation, activities are primarily concentrated in metropolitan areas and three major urban agglomerations. The innovation networks of the NEV industry in China are primarily concentrated in the Beijing-Tianjin-Hebei and Yangtze River Delta regions; the innovation networks in the Pearl River Delta region are significantly weaker. Additionally, regions with poor innovation could achieve more innovation cooperatively. (2) For the network characteristics, the national innovation network presents a “core-edge” structure, and the State Grid is the most important innovation actor of the network. In the Beijing-Tianjin-Hebei region, large state-owned enterprise groups control the network which has a prominent “core-edge” structure, the most active collaborative innovation, and a high degree of network extroversion. Regarding the innovation network in the Yangtze River Delta, the types of actors in the region are diversified, the “core-edge” structure is prominent, the intensity of cooperative innovation is high, and the degree of network extroversion is relatively high. In the Pearl River Delta, private enterprises are the principal actors in the network, the regional network structure is loose, cooperative innovation is limited, and the network is highly extroverted. (3) For regional proximity mechanisms in the Beijing-Tianjin-Hebei region, the Grid Group strongly promoted the formation of cross-regional networks. In the Yangtze River Delta, the State Grid and large regional enterprises have influenced the formation of networks, and abundant knowledge sources have promoted cooperation. In the Pearl River Delta, the impact of geographical proximity on the cooperation and innovation in private enterprises is small, and knowledge demand has promoted cross-regional cooperation. Based on these results, we present some policy recommendations in industrial and regional dimensions.

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[43]姜智文. 从硬件向软件转化汽车供应链发生重大改变[EB/OL]. 2022-07-06 [2022-10-03]. https://baijiahao.baidu.com/s?id=1737563614459983374&wfr=spider&for=pc.

[

Jiang Zhiwen, The automobile supply chain has undergone significant transformations, spanning from hardware to software. 2022-07-06 [2022-10-03]. https://baijiahao.baidu.com/s?id=1737563614459983374&wfr=spider&for=pc.]

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}[44]随州市人民政府研究室. 随州市新能源汽车产业高质量发展调研报告[EB/OL]. 2023-03-20 [2023-03-31]. http://www.suizhou.gov.cn/xwdt/zwdy/202303/t20230320_1087515.shtml.

[Research Office of Suizhou Municipal People's Government. Research report on the high-quality development of the new energy vehicle industry in Suizhou City. 2023-03-20 [2023-03-31]. http://www.suizhou.gov.cn/xwdt/zwdy/202303/t20230320_1087515.shtml.]

{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}{{custom_ref.label}}{{custom_citation.content}}https://doi.org/{{custom_citation.doi}}https://www.ncbi.nlm.nih.gov/pubmed/{{custom_citation.pmid}}{{custom_citation.url}}本文引用 [{{custom_ref.citedCount}}]摘要{{custom_citation.annotation}}致谢

衷心感谢匿名审查专家在文章框架、文献综述等方面提出建设性修改意见!

0}}" class="main_content_center_left_one_title zhengwem_title yijibiaotidkk">{{custom_ack.title_cn}}

{{custom_ack.content}}基金

上海市哲学社会科学规划一般课题(2019BCK009)

国家自然科学基金项目(42171168)

上海师范大学理工科科研发展基金项目

教育部基地重大课题(22JJD790071)

{{custom_fund}}网址:中国汽车制造业企业区位及其影响因素 http://c.mxgxt.com/news/view/210512

相关内容

中国汽车芯片行业研究与行业竞争对手分析报告中国汽车模特大赛

中国十大著名企业家 各行业知名企业家盘点 中国最具影响力的十大企业家→买购网

2024年汽车广告行业发展现状分析 汽车广告行业市场规模及未来趋势分析

汽车行业竞争分析

一张图看懂:为什么中国制造业产业链无法被取代?

破“卷”成蝶——2024年“25位年度影响力企业领袖”数据解读

2024年Q3中国移动互联网流量季度报告:汽车之家行业影响力稳步提升

理性看待汽车业饭圈化

中国抗生素行业应用 中国抗生素行业企业竞争现状分析